Isn't it time you felt good again?

Welcome to NIXA CHIROPRACTOR PLUS

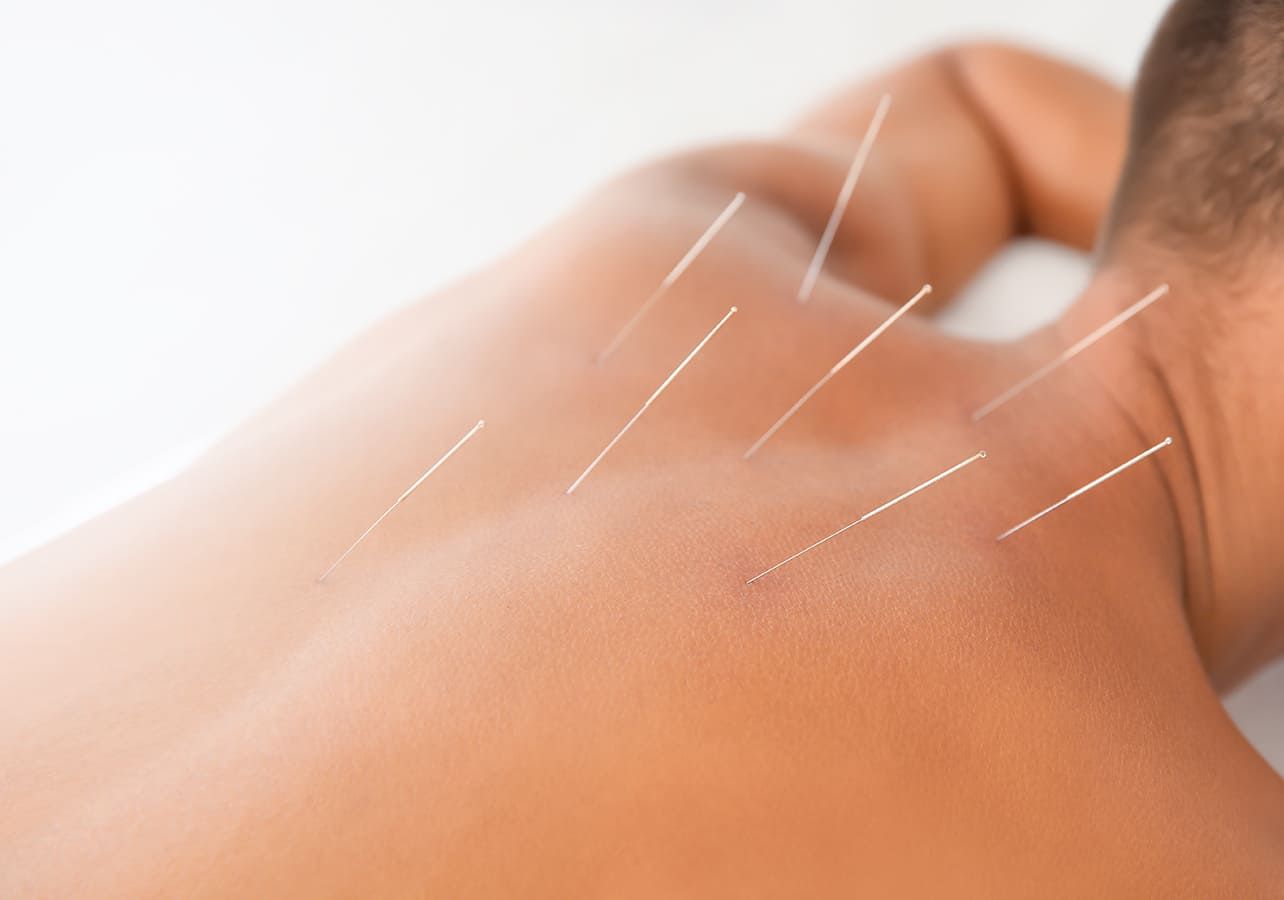

Chiropractic / Acupuncture / NaturopathicExperience Fast, Natural Pain Relief with Lasting Results.

Same Day Appointments / Walk-ins Welcome

Open 5:00 AM Mon-Sat except Wed

$30 Chiropractic Adjustments

Adjustment On Your First Visit

Spinal Decompression / Naturopathic Therapies

Provider for Blue Cross Blue Shield and Ambetter

Comprehensive Approach to Your Health Care

Who comes here

We take care of individuals and families who want to live a healthier life with less pharmaceuticals and surgeries.

People with busy lives love our office. We do our best to keep our patients scheduled so that there is a minimal wait. We are open at 5:00 AM, including Saturdays, and we accept walk-ins..

Your Nixa chiropractor and naturopathic physician Dr. Hunter Greenwood takes care of patients from newborns to the elderly. We offer spinal manipulations, acupuncture, spinal decompression, naturopathic therapies, exercise, nutritional counseling, and herbal remedies.

WHY THEY COME

What we do here is Unique and Different – Combining his 39 years of experience with his chiropractic, naturopathic, acupuncture, and medical training, Dr. Greenwood approaches health care differently than most other chiropractors and physicians.

Dr. Greenwood treats each patient as an individual, utilizing state of the art equipment and many techniques that he has developed himself. Some patients drive over an hour to receive care at our Nixa clinic.

If you are looking for a new approach to resolve your health concerns, you may want to try what we have to offer.

We are here when you are ready to start your journey back to health and wellness.

Meet DR. HUNTER GREENWOOD

Chiropractic Physician +Naturopathic Physician +

Missouri Board Certified Acupuncture

Looking for a chiropractor in Nixa who will listen to your concerns and help you get pain relief? Dr. Hunter Greenwood has 38 of years experience treating patients with difficult and chronic health conditions.

'Pain distracts you; it demands that you focus on pain instead of your work, your family or the other activities you enjoy most in life. It eats at the heart of your day until you can no longer ignore it. My goal is to free you from that pain so that you can focus on the things that mean the most to you.'

"Dr. Greenwood has been a blessing. He has helped me tremendously with my bad disc problem in my low back. I have seen several chiropractors, but non like him. I wish he lived next door to me, but an hour drive is well worth it in my opinion! He is fantastic!"

Maggie B.